capital gains tax increase canada

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. On June 18 1987 Finance Minister Michael Wilson announced that the rate would increase to 6623.

Cryptocurrency Taxes In Canada Cointracker

In 1972 due to the Carter Commission Reports famous conclusion that a buck is a buck is a buck Canada.

. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large. The current tax preference for capital gains costs 35 billion annually with high-income families accruing most of the benefit. Special to The Globe and Mail.

As of 2022 it stands at 50. Capital Gains Tax in Canada 2022. If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

For example the Department of Finance proposed an increase to the capital gains inclusion rate in its 1987 white paper on tax reform. If these rules apply to you you may be able to postpone paying tax on any capital gains you had from the transfer. The 1988 amendments to section 38 of.

The capital gains tax is the same for everyone in Canada currently 50. As you can see the end result shows that the increase in the capital gains inclusion rate to 75 increases the overall taxes by 1338. When you buy a home you must pay tax on its fair market value at the time of purchase.

Since the inclusion rate for capital gains is 50 your taxable income would increase by 5000 in the 2021 tax year. The inclusion rate is the percentage of your gains that are subject to tax. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

So for example if you buy a stock at 100 and it earns 50 in value when you sell it the total capital. From 1867 to 1971 there was no capital gains tax in Canada. If you bought a cottage for 200000 and now sell it for 500000 you will receive.

In Canada capital gains are taxed very favourably with only 50 of a capital gain being taxable. To emphasize how favourable this is consider a. How to prepare for a potential tax hike on capital gains.

The 50 percent inclusion rate remained in place until the late 1980s. Different types of realized capital gains are taxed by. To address wealth inequality and to improve functioning of our tax system tax rates on capital gains income should be increased.

The inclusion rate refers. In this commentary we discuss the findings from our new research on the estimated impact of the 1994 reform that dramatically increased the tax rate on capital gains. Capital Gains in Canada.

In other words for every 100 of. After income taxes and the inflation tax Investor A ends up with a 77-per-cent return the same return as Investor B who was taxed on 100 per cent of her capital gains. Capital Gains 2021.

Appendix Top 2020 marginal tax rates for capital gains and dividends The following table illustrates the current top marginal tax rate on capital gains by provinceterritory as well as the. Published January 12 2021 Updated February 9 2021. The inclusion rate has varied over time see graph below.

The current tax preference for capital gains. The recent passage of Bill C-208 exacerbates. 1 week ago Jul 07 2022 The taxes in Canada are calculated based on two critical variables.

Should Canada Hike Taxes On Investment Income Not So Fast Macleans Ca

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Capital Gains 101 How To Calculate Transactions In Foreign Currency

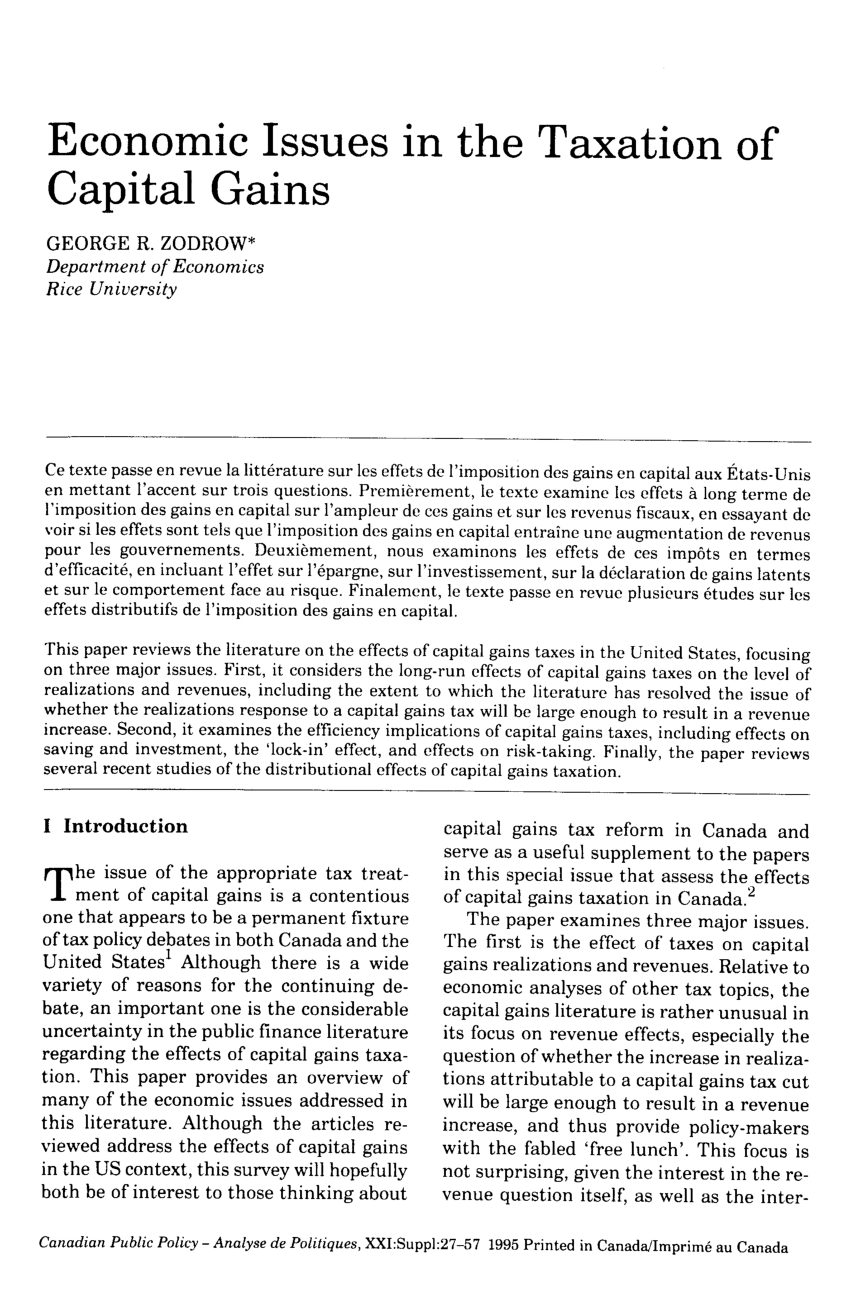

Pdf Economic Issues In The Taxation Of Capital Gains

How Capital Gains Are Taxed In Canada

Ten Reasons To Reform The Tax Code Reason 8 Ten Reasons To Reform The Tax Code Reason 8 United States Joint Economic Committee

The Bush Capital Gains Tax Cut After Four Years More Growth More Investment More Revenues

These Are The Obama Tax Hikes That Will Really Hurt American Enterprise Institute Aei

How To Avoid Capital Gains Tax On Property Rental In Canada Canada Buzz

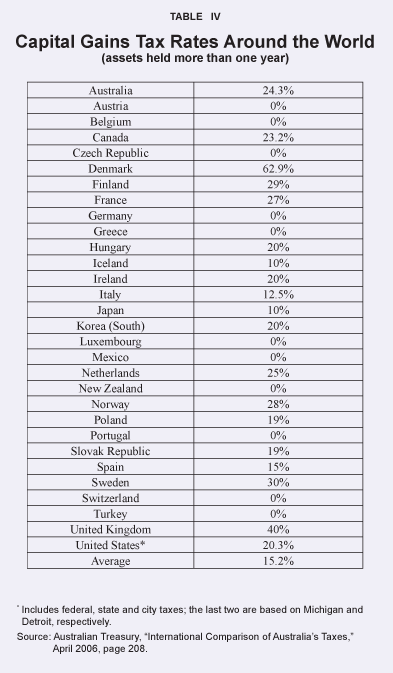

Key Differences Between Canada And Us Tax Capital Gains Venture Cfo

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

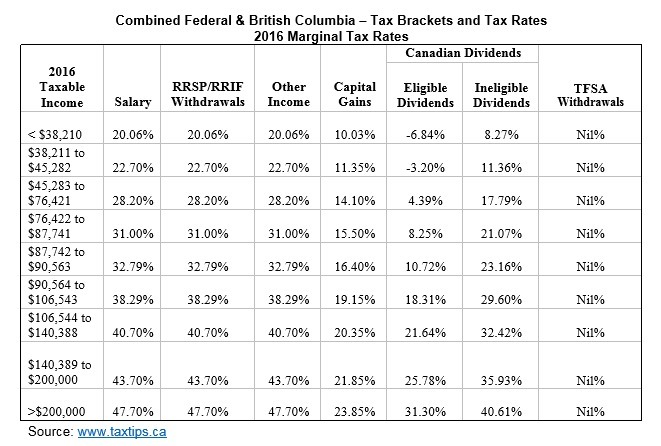

2016 Federal Budget Commentary Pacific Spirit Vancouver Financial Advisors Wealth Management

Canada Capital Gains Tax Calculator 2022

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

Capital Gains Tax Hike Would Be Disastrous For Economic Recovery Fraser Institute

How Are Capital Gains Taxed Tax Policy Center

The Capital Gains Tax And Inflation How To Favour Investment And Prosperity Iedm Mei

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)